|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Best Rate FHA Streamline Refinance: What to Expect and How to Stay InformedUnderstanding FHA Streamline RefinanceThe FHA Streamline Refinance program is designed to help homeowners with existing FHA loans reduce their monthly payments and interest rates with minimal paperwork. This process is simplified, making it a popular choice for those looking to save money without the hassle of a full refinance. Eligibility Criteria

Benefits of FHA Streamline RefinanceThere are several advantages to choosing an FHA Streamline Refinance. These include:

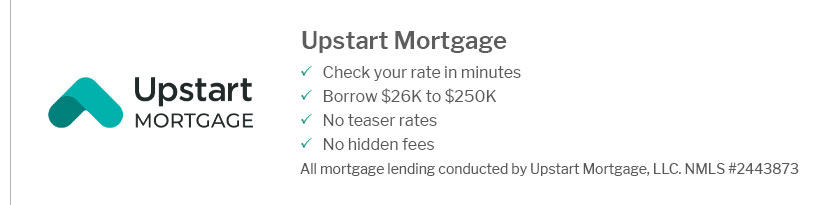

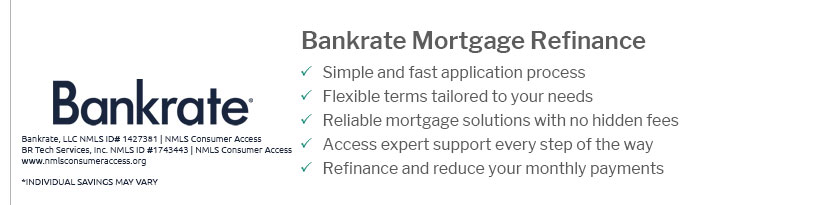

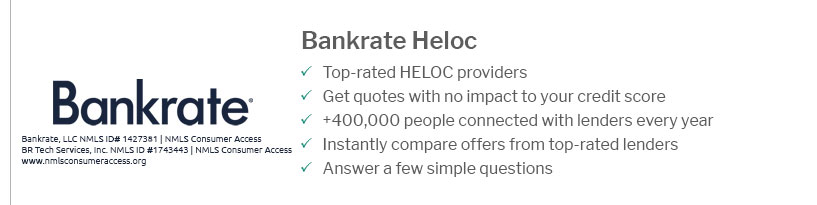

Finding the Best RateSecuring the best rate for your FHA Streamline Refinance is crucial for maximizing your savings. It's essential to shop around and compare offers from different lenders. One useful resource is refinance loan california, where you can explore various options and find competitive rates. Tips for Getting the Best Rate

FAQs About FHA Streamline RefinanceCan I refinance if I have a second mortgage?Yes, you can still qualify for an FHA Streamline Refinance if you have a second mortgage, but you must obtain a subordination agreement from your second lender. Do I need to pay closing costs?While closing costs are typically required, some lenders offer a 'no-cost' refinance by charging a slightly higher interest rate to cover these expenses. How long does the refinance process take?The FHA Streamline Refinance process is usually quicker than traditional refinancing, often taking around 30 to 45 days to complete. ConclusionFHA Streamline Refinance is a practical option for those looking to reduce their mortgage payments effortlessly. To ensure the best outcome, keep yourself informed and consult reliable sources like refinance me now for expert advice and current rate comparisons. By understanding the process and exploring your options, you can make a well-informed decision that best suits your financial needs. https://www.credible.com/mortgage/best-fha-streamline-refinance-lenders

Rocket Mortgage: Best for borrowers seeking a robust online experience - Freedom Mortgage: Best for borrowers seeking a quick closing - Guaranteed Rate: Best for ... https://www.freedommortgage.com/fha-loans-streamline-OLD

FHA loan with a new FHA loan that has a better rate. It ... https://www.quickenloans.com/home-loans/fha-streamline

FHA Streamline refinances are best for current FHA loan borrowers who want to lower their monthly mortgage payment.

|

|---|